|

The Moscow bankruptcy court has ordered a bankrupt debtor to provide information about his cryptocurrency holdings. The trustee has requested that his cryptocurrencies be included in the bankruptcy estate. The court will decide if the coins can be used to pay creditors. Also read: Japan’s DMM Bitcoin Exchange Opens for Business With 7 Cryptocurrencies Court Orders Debtor to Provide Crypto DetailsThe Moscow Arbitration Court has ordered Russian citizen Ilya Tsarkov, who has been declared bankrupt, to provide information about his cryptocurrency holdings, RIA Novosti reported from the courtroom. The appointed trustee for the case, Aleksey Leonov, told Rapsi, as translated by Crime Russia:

Citing that Tsarkov had revealed his possession of an online wallet at Blockchain.info, “Leonov demanded that the funds in the debtor’s wallet be included in the bankruptcy estate and Tsarkov be obliged to provide him with the password,” the news outlet elaborated. Judge Larisa Kravchuk ordered Tsarkov to disclose the balance of his cryptocurrency holdings by February 26 when the court will reconvene and decide whether his cryptocurrencies can be used to settle with creditors. Should Cryptocurrency Be Included in a Bankruptcy?

Currently, “According to clauses 1 and 3 of Article 213.25 of the Law on Insolvency, all property of a citizen available as of the date of the decision of the Arbitration Court to declare him bankrupt,” and any assets acquired after that date, “constitute the bankruptcy estate, with the exception of property that cannot be recovered in accordance with the law,” the trustee was quoted by the news outlet. He explained:

Do you think cryptocurrency should be included in the bankruptcy estate? Let us know in the comments section below. Images courtesy of Shutterstock. Need to calculate your bitcoin holdings? Check our tools section. The post Russian Bankruptcy Court Orders Debtor to Disclose Cryptocurrency Holdings appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/russian-bankruptcy-court-orders-debtor-to-disclose-cryptocurrency-holdings/

0 Comments

Looking at mainstream media headlines over the past few weeks shows a lot of columnists and pundits have declared that ‘bitcoin’s bubble has burst.’ They always claim that it’s much safer to invest in traditional investments like equities or the stock market while at the same time highlighting cryptocurrency’s volatile price swings. However, on Monday, February 5th the Dow Jones Industrial Average dropped more than 1,175 points, losing more value in one day than the entire cryptocurrency ecosystem over the past six weeks. Also read: Market Risk Advisory Committee: Bitcoin Futures Self-Certification Works The Black Monday of 2018It was a ‘Black Monday’ on February 6 when both global stocks and the entire cryptocurrency ecosystem shed billions yesterday. The Dow Jones Industrial Average (Dow) and a good portion of stocks worldwide plummeted at 2:40 pm EDT; more so than the drops during the 2008 economic crisis. Yesterday’s stock market dip broke records not only bringing up memories of 2008 but the day was also very similar to the other ‘Black Mondays’ of 1929, 1987, and 2000. However, mainstream media is not so quick to call the stock market slump a ‘crash,’ a ‘bubble pop,’ or even a death spiral. Yet the Dow lost more value ($300 billion USD) than the entire crypto-bear run of 2018 in one intraday.

Some Reports Say the Stock Market Sell-Off Pushed Money Towards Crypto-InvestmentsIn addition to the grueling stock market madness, the financial publication Business Insider published a report that stated, “money was pouring into crypto during the stock market’s selloff.” The Dow started to nosedive at 2:40 pm EDT, and twenty minutes later the entire cryptocurrency capitalization according to Coinmarketcap spiked 7 percent one hour later. “Cryptocurrencies got whacked alongside equities last week,” explains the report on Monday evening.

Yesterday BTC/USD markets tumbled 20 percent in 24-hours reaching a low $5,900 which shaved $18 billion USD from its market cap. The following day BTC markets have rebounded considerably back above the $7,200 price territory. The Dow average took another hit during the opening bell on Tuesday, losing 500 points but has since recovered much of the morning loss. However the Dow, S&P 500, Nasdaq, and a vast swathe of traditional investments still look unsettling. The Dow is showing some slight recovery, but many other mainstream investment vehicles are still nurturing losses. Moreover, European stock markets are declining rapidly after U.S. and Asian markets were routed. Mainstream News Outlets Have No Problem Saying Bitcoin Is Dead But They Think Twice When It Comes to the Global Stock MarketOver the past week, mainstream news outlets have had no problem calling bitcoin markets ‘dead’ and publishing reports stating that it will never recover. There are at least seven new editorials per day stating that bitcoin is “done” since the beginning of January. There’s no hesitation towards telling the public that the dream of cryptocurrencies has come to an end, and many columnists are telling people to sell. On Tuesday, February 6, mainstream media’s outlook on the stock market is gloomy, but there’s not that many (if any at all) editorials about the stock market ‘crashing,’ or the ‘stocks bubble has popped.’ The only ones calling the stock market ‘dead’ are the lesser known ‘conspiracy-like’ publications. Mainstream media pundits wouldn’t dare shake the market with headlines saying that traditional markets are in a ‘death spiral.’ But with cryptocurrencies, these ‘news outlets’ could not care less about spreading FUD among the crypto-investment crowd.

The Stock Market Can Be Far More Dangerous Than CryptoThe truth is stocks, bonds, equities, and nation-state issued currencies can suffer from extreme volatility. Some nation-state currencies are so worthless people weigh bags of cash on scales rather than counting. Moreover, stock markets can cause significant disruption to retail investors, and way more than the digital currency ecosystem governments warn everyone about. Stock market crashes can collapse an entire housing market, banks close in record numbers, and in some cases, there can be a run on the banks. This week U.S. regulators mentioned the ‘dangers’ cryptocurrencies could bring to retail investors during a congressional hearing, but of course, they failed to mention that regulated and centralized markets can be even more dangerous. What do you think about the stock market tumble in comparison to bitcoin markets? What do you think is more dangerous? Let us know in the comments below. Images via Pixabay, CNN, WSJ Feb.5, and Business Insider. The Bitcoin universe is vast. So is Bitcoin.com. Check our Wiki, where you can learn everything you were afraid to ask. Or read our news coverage to stay up to date on the latest. Or delve into statistics on our helpful tools page. The post ‘Black Monday’ Shows Bitcoin Isn’t As ‘Dangerous’ As Regulators Claim appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/black-monday-shows-bitcoin-isnt-as-dangerous-as-regulators-claim/ A hectic and bearish overnight session was followed by a strong bounce in the cryptocurrency segment, as the stock market, which experienced the largest sell-off in years, also rebounded. Bitcoin recovered above $7500 after hitting a low near $6000, and while most of the majors followed the largest coin, several currencies showed relative strength again. Despite the strong correlation between the coins, Litecoin, Dash, IOTA, Ripple, and Stellar are all trading above last week’s lows and that leadership points to a weakening of the selling pressure, despite the new lows in most of the coins. Bitcoin, on the other hand, is still stuck the previous low near $7650 following the widely watched SEC and CFTC hearings, as the long-term picture in the coin is now clearly oversold. While the downtrend is still intact the cycle low is likely in or very close, and investors could continue to accumulate the coin near the major support levels, although traders should still wait with opening new positions. Above $7650, primary resistance is between $9000 and $9200, while support is found between $6750 and $7000, and at $6150 and $5750. BTC/USD, 4-Hour Chart Analysis Ripple is among the relative stronger coins, as it only fell to a marginal new low during yesterday’s sell-off and now it is back above the $0.68 level following the bounce. The coin is oversold from a long-term perspective and we expect a durable rally to start soon, so investors and aggressive traders could enter positions near the main support levels. Resistance levels ahead at $0.85, $1, $1.25, and $1.5, while below $0.68, significant support is found at $0.42. XRP/USDT, 4-Hour Chart Analysis EthereumETH/USD, 4-Hour Chart Analysis Ethereum is trading right at the previous low near $740 after testing the $575 level yesterday. The coin is now getting oversold from a long-term perspective, but we expect the correction to continue, and a re-test of the lows is likely. That said, investors could be looking for early entry points near the main support levels on the short-term sell-offs, while traders should still wait before entering new positions. Support levels are still found at $625 and $575, while resistance above $740 is ahead near $850. LitecoinLTC/USD, Daily Chart Analysis Litecoin has been the strongest major for several days now, and the coin maintained its relative strength during yesterday’s selloff and during today’s bounce as well. The digital currency recaptured the key $125 level again, and it’s likely headed above the next major level at $140. Long-term investors and aggressive traders could still enter new positions on the short-term sell-offs, as the long-term picture is still oversold, with further resistance ahead between $170 and $180. DashDASH/USD, 4-Hour Chart Analysis Dash is trading near the $500 level after the strong rebound today, and the coin only briefly fell below the prior low, and the encouraging recovery means that a bottoming process is likely underway. With the long-term picture being oversold investors could still add to their holdings. Resistance is head between $600 and $650 and around the $825 level, while support is found at $410 and $360. Ethereum ClassicETC/USD, 4-Hour Chart Analysis Ethereum Classic is only a tad stronger than Bitcoin from a technical perspective, trading right at the $18 level after hitting a new low near $14 during yesterday’s plunge. While the downtrend is still intact, the long-term picture is oversold, and we expect a durable rally soon, with further strong support at $16 and resistance ahead at $23. MoneroXMR/USD, 4-Hour Chart Analysis Monero bounced back above the $200 level after testing the previous key break-out level at $150, and the coin is now oversold from a long-term perspective. The currency likely hit a cycle low yesterday, and investors should add to their holdings near the main support levels, while traders should wait for a trend change before entering new positions. Resistance levels are ahead at $240, $280, and $300, while support below $175 is found at $150. NEONEO/USDT, 4-Hour Chart Analysis NEO turned higher right off the $64 support yesterday and it’s now trading back at the $100 level, with the long-term picture being neutral after the correction. We still expect the correction to continue, although the final low might be in, and long-term investors could already add to their positions near the main support levels. Resistance levels are ahead at $125 and just above $150, while support is at $80 and $64. IOTAIOTA/USD, 4-Hour Chart Analysis IOTA recovered quickly above the key $1.50 level, and it’s among the relatively strong coins yet again. The long-term picture is deeply oversold and a durable rally could be imminent. While the downtrend is intact, investors could still accumulate the coin, with resistance ahead just below $2, near $2.2, and at $2.35. Featured image from Shutterstock Disclaimer: The analyst owns cryptocurrencies. He holds investment positions in the coins, but doesn’t engage in short-term or day-trading, nor does he hold short positions on any of the coins. The post Technical Analysis: Coins Stabilize amid Positive Divergences appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/technical-analysis-coins-stabilize-amid-positive-divergences/ Australian gambling regulator Northern Territory Racing Commission (NTRC) has issued an informal ban against all cryptocurrency online wagering, singling out bitcoin and ethereum. Just days before, one of its licensed online gambling sites announced it was offering bitcoin to its customers. Also read: Market Risk Advisory Committee: Bitcoin Futures Self-Certification Works Neds Adopts Bitcoin GamblingPaul Cherry CEO of Australian online gambling site Neds explained: “We strongly believe in bitcoin and cryptocurrencies as a viable and secure method of online exchange. With this announcement we wanted to ensure that Australians who share our positive outlook on cryptocurrencies can use them to bet with us.” “We’ve always prided ourselves on being a technology company,” he continued. “We’re not just sports and racing enthusiasts and bookmakers – we’re also programmers, analysts and computer nerds – so this felt like a natural step for us. And we think there is a lot of crossover into that target [crypto] market.”

The Brisbane, Australia online gambling website received a great deal of notice for its acceptance of bitcoin. Billed as the first of its kind for the continent nation, Neds even had plans to incorporate alternative coins. Neds also claimed it would absorb over 2 percent of the transaction fees incurred by users. Neds was licensed by Fall of last year, ready to go, with all wagering happening in bitcoin, from the bet to eventual withdrawal. Mr. Cherry mused: “It is a technological solution, and we see ourselves as tech guys, so it seems very fitting that we integrate bitcoin or some other cryptocurrencies into our platform. A lot of people may be non-sophisticated investors who have acquired some bitcoins during the recent hype and are probably wondering what to do with them.” Regulator Teases BanAnd then it all came crashing down within days. At press time, the cypto.neds.com.au site redirects to its formal platform, and all traces of bitcoin seemed to have vanished, including in its search function. Earlier, that very page carried the warning: “Our site is currently offline pending further instruction from NT Racing Commission.”

In an email obtained by The Australian Financial Review, regional gaming regulator NTRC stressed it “is intending to issue a formal communique to all sports bookmakers and betting exchange operators licensed in the NT if currently transacting in cryptocurrency (for example Bitcoin, Ethereum and the like) for their wagering operations to immediately cease and desist.” For whatever reason, the Australian government has had what local press are calling an “antagonistic stance regarding cryptocurrency”, going so far as to place limits on those licensed from competing with international wagering outfits online: broadcast ads are restricted as are types of poker and other games. Businesses unresponsive to the likes of emails above risk losing favorable tax advantages along with license generally. In the meantime, Neds continues offering its online Aussie clientele wagers in fiat. What do you think about Australia’s move against bitcoin gambling? Let us know in the comments section below. Images courtesy of Pixabay, Neds. The Bitcoin universe is vast. So is Bitcoin.com. Check our Wiki, where you can learn everything you were afraid to ask. Or read our news coverage to stay up to date on the latest. Or delve into statistics on our helpful tools page. The post Australia to Ban Bitcoin Gambling appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/australia-to-ban-bitcoin-gambling/

IBM’s A Boy and His Atom I recently came across a book called Breaking the Habit of Being Yourself by Dr. Joe Dispenza. I had to drop the book after a couple of chapters. It seems the entire basis for the book is based on a misunderstanding of Heisenberg’s Uncertainty Principle and the observer effect. I’m surely being picky here, and it’s likely the case that Dr. Dispenza has solid advice on how to break habits; it is my own ego that prevented me from reading further, not necessarily Dispenza. But I would still like to clear the air here and explain how we should interpret Heisenberg’s Uncertainty Principle. Dr. Dispenza starts the book by explaining what he thinks the observer effect is. It has been theorized that an electron may be in every place at once, but then once observed, our very act of observing that the electron fixes its position. Because of this, Dispenza seems to be under the impression that conscious minds have the ability to influence the objective universe as we view it. Mind over matter, basically. And he then proceeds to use this as a motivational tactic; the wishful thinking that you have the power to change the world! No you don’t. Not like that at least. Physicists use this observer effect term to describe the problem that humans have to see what they’re experimenting on, and visible light can influence those experiments. Light itself interacts with electrons, so to shine a light on an electron in hopes of measuring it will actually disturb it by changing its momentum. It’s not the act of seeing that changes the circumstances of particles, it’s the other variables that must be present in order for us to see. Now Heisenberg’s Uncertainty Principle is a law of nature that seemingly prohibits us from measuring the exact position of a wave particle and simultaneously calculating its momentum. For thousands of years, western science has thought of the microscopic world as being made up of little balls of stuff, and most of us were brought up believing the same thing. However, the closer we look, the more we’re beginning to realize that the Eastern world had a better theory for the fundamental nature of the stuff around us. The world doesn’t seem to be made up of little balls that revolve around other little balls. It seems to behave more like vibrations in spacetime.

How particles are better imagined Much of the confusion in science comes from the failing of words, mostly because we’re still working out what the best definitions of those words should be. So when someone uses the word particle, don’t think of a little ball of stuff; this is now an outdated word that implies too many solid structural properties.

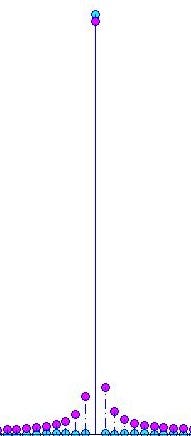

Wave at single point in time In the most basic sense of the principle, you can think of the uncertainty phenomenon as trying to nail Jello to a wall. A similar problem occurs when we try to measure the position of a sound wave. So tell me, where exactly is a sound wave located? Is it even possible to locate any wave? In a sense, yes, we can estimate the greatest spike of that wave by cutting this wiggle into even smaller sub-wiggles, until we get the greatest spike of that wiggle in a single point in time. But at this point, we run into another problem. Since we’ve cut this wave into the smallest possible wiggle, we no longer can measure it’s frequency. Remember, the frequency of a wave is the amount of crests or troughs over a given period of time; since we’ve compressed the wave to a single point in time, it doesn’t really have a frequency. So this is like a position/frequency uncertainty principle for sound waves. We haven’t totally cracked the explanation of Heisenberg’s principle; the quantum world is more mysterious. But both of these uncertainty statements describe how much information we are ever able to extract from a system. Here’s the best video I’ve come across on the subject. Thank you PBS Spacetime. With electrons and other particles it’s a little weirder. Heisenberg’s Uncertainty Principle basically says that we can never know both the position of a wave particle and its momentum. Here’s a video by Veritasium that shows the principle in action. His explanation for why the world behaves this way is rather lacking.

I’m sure he’s a very intelligent guy in all other respects, but explanations like this just confuse people. Instead of trying to insinuate that the math itself affects the behavior of particles, it’s better to simply say, we don’t know why the hell this is happening, but it’s happening. We don’t know much at all about the why of quantum physics. We’re still working out the what part. Sometimes physicists don’t like to admit this, and may say things like, “2+2 can equal 5;” basically trying to imply that we should ignore logic, because we’ve found that our universe relies on paradoxes. I don’t think this can be the case, or that physics can’t be explained logically. Throughout time, people have always found what they thought to be paradoxes, (a round Earth that people don’t fall off of, for instance), and these paradoxes were always explained away through logic as time went on. The same will happen to quantum physics eventually. We simply don’t know enough right now to properly explain it. But we do know something for sure, we don’t have telekinesis. The post Heisenberg’s Uncertainty Principle Doesn’t Mean You Have Telekinesis appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/heisenbergs-uncertainty-principle-doesnt-mean-you-have-telekinesis/ This is a paid press release, which contains forward looking statements, and should be treated as advertising or promotional material. Bitcoin.com does not endorse nor support this product/service. Bitcoin.com is not responsible for or liable for any content, accuracy or quality within the press release. XinFin opens token sale of it’s utility tokens, unveils the first of it’s kind hybrid blockchain XDC protocol Singapore based XinFin unveiled the first of its kind Hybrid Blockchain protocol architecture for enterprise adoption for global trade and finance market, opens sale of it’s utility tokens. XinFin unveiled its Hybrid Blockchain network, powered by the XDC protocol. The XDC protocol enables real world enterprises to work with Blockchain and digital assets ecosystem with a network architecture that combines best features of public blockchains and private networks. The XDC protocol has been architected to make it compliant with laws of the land and can work purely as a messaging layer for existing and approved payment mechanisms in any country. The ERC20 utility token XDCE is hosted on decentralised ethereum Ecosystem and will let global enterprises work with XDC Protocol. The XDCE utility tokens are now available through it’s public ICO. The utility tokens will help get access to the XDC protocol and its subnetworks by hosting XDC masternodes. Youtube : https://www.youtube.com/watch?v=K-tHZkV6zAs Token Sale Page : www.xinfin.io XinFin raised over USD 1.5 million in a private sale in July-August 2017 and utilized the funds to build it’s XDC hybrid blockchain protocol and the tradefinex.org app meant for bridging the global infrastructure deficit. Over a half a dozen PoCs have been completed on the XinFin network and the proceeds from current round of token sale will be used to extend the PoCs into sizeable pilot projects with enterprises and institutions around the world. The funds will also be utilized for ecosystem development and masternodes proliferation of the XinFin network amongst institutions. “The major hurdles for mainstream adoption of Blockchain ecosystem is the power intensive mining process, highly congested trust less networks, security and scalability. The XDC protocol is designed considering real world applications in global trade and finance. It has also been designed to make sure the enterprises that work with XDC protocol can work with full regulatory compliance.” Said Alex Mathbeck, head of marketing at XinFin. “XinFin has architected its hybrid network from a fork of Quorum. The network consensus is two tiered. Along with a PBFT derived consensus mechanism between nodes, XinFin has implemented a stake based rule set that governs node participation. “The various tiers of XinFin master nodes makes it flexible for participants to work with the XDC protocol in a secure environment. The XDC can act as a pure messaging and confirmation layer using existing payment rails or as a settlement layer through approved and regulated institutions.” added Mr. Alex Mathbeck. Tradefinex.org is the first of the distributed app launched in beta environment that uses the XDC protocol. TradeFinex is a smart contracts User Interface for global trade and finance using XDC Protocol. Tradefinex application is aimed at helping enterprises and policy makers to minimize inefficiencies in the $27 trillion annual infrastructure and international trade market. TradeFinex platform was inaugurated at the 2nd Global Summit on P2P Digital Asset System Summit held in India and is being extended to leading trade associations, financial institutions and regulators worldwide. XinFin network has initiated onboarding of global alliances and developer communities to build disruptive Apps on XDC protocol to improve business process efficiency. Telegram : https://t.me/xinfintalk Contact Email Address This is a paid press release. Readers should do their own due diligence before taking any actions related to the promoted company or any of its affiliates or services. Bitcoin.com is not responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or `reliance on any content, goods or services mentioned in the press release. The post PR: XinFin Unveils XDC, the Hybrid Blockchain Protocol; Opens Its Utility Token Sale appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/pr-xinfin-unveils-xdc-the-hybrid-blockchain-protocol-opens-its-utility-token-sale/ AdvertisementGet Trading Recommendations and Read Analysis on Hacked.com for just $39 per month. The chairmen of two top US market regulatory agencies largely stuck to the script during Tuesday’s Senate hearing on potential cryptocurrency regulations. The hearing, which was held by the Senate Committee on Banking, Housing, and Urban Affairs, touched on a broad range of regulatory concerns related to cryptocurrencies and blockchain technology, including initial coin offerings (ICOs), trading platforms, derivatives and exchange-traded funds (ETFs), and the assets’ perceived use to perpetrate financial crimes and subvert international sanctions. In their opening statements, both Clayton and Giancarlo expressed concern about the fact that cryptocurrency exchanges are currently regulated at the state level rather than the federal, and each reiterated that, at some undefined point in the future, Congress may want to increase federal regulators’ ability to oversee the spot markets. Jay Clayton, chairman of the Securities and Exchange Commission (SEC), continually shifted the conversation back to ICOs, noting that he has not seen an ICO that should not be classified as a security under federal regulations — a statement he has repeated on several past occasions. He also provided insight into why the SEC has resisted fund sponsors’ attempts to list Bitcoin ETFs, explaining that because ETFs primarily target retail investors and are largely one-sided markets, rules governing their creation must be more strict than those for futures contracts, which are overseen by the CFTC. He said that, if these rules are satisfied at a later date, the SEC will then be open to reviewing its stance on Bitcoin ETFs. Chairman Giancarlo, meanwhile, won the hearts of Bitcoin enthusiasts with several comments that appeared to be hat tips to the community. First, he made what is almost certainly the first use of the word “hodl” during a Congressional hearing. Then, toward the end of the hearing, he contradicted the common misconception that Bitcoin is riding the coattails of blockchain technology. He told the committee: [embedded content] Altogether, the hearing may not have led to any bombshells, but it confirmed what has already been made apparent: new cryptocurrency regulations are likely coming to the US market. “We may be back with our friends from the U.S. Treasury and the Fed to ask for additional legislation,” Chairman Clayton said during the hearing, and — based on the tone of questions from individual committee members — legislators are likely to give it to them. Featured image from YouTube/CFTC. Follow us on Telegram. Advertisement The post Without Bitcoin, There Would Be No Blockchain: CFTC Chairman Tells US Senate appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/without-bitcoin-there-would-be-no-blockchain-cftc-chairman-tells-us-senate/ AdvertisementGet Trading Recommendations and Read Analysis on Hacked.com for just $39 per month. The timing of the rollout couldn’t be better. Zug, Switzerland-based bitcoin wallet startup Bread unveiled plans to accept international bitcoin purchases via credit card. Bread is boasting features such as “high limits” and same-day delivery for bitcoin purchases, both of which are often missing from cryptocurrency exchanges. By allowing this service, which is a product of a relationship with Simplex, investors can bypass cryptocurrency exchanges, which incidentally top US banks have taken aim at of late. Bread tweeted – While Bread is making it easier for investors to get their hand on bitcoin, banks are making it more difficult. JPMorgan Chase, Bank of America, Citigroup and Lloyd’s in recent days placed a ban on bitcoin purchases via credit card. Cryptocurrency exchanges appear to be tops on banks’ radar for credit card bitcoin purchases. Bread’s decision, meanwhile, came in response to customer demand amid the following idiosyncracies with exchanges –

The Bread app, meanwhile, gives investors what they’re missing from the likes of Coinbase –

Perhaps the best feature of the Bread wallet is it puts the private key in the accountholder’s hands, removing the need to trust a third-party service provider, a decentralized approach that is similarly at the core of the blockchain. This is unlike exchanges, where if a buyer doesn’t own their own digital wallet, the bitcoin is automatically kept in the exchange’s wallet, which as the Coincheck showed the world can be a risky bet in the event of a breach. Bread also draws the conclusion that fees are not an area of concern for investors, which crypto traders may take issue with, especially considering the highly anticipated launch of Robinhood. Bread’s theory is that considering the volatility in the bitcoin price, a buyer’s No. 1 concern when purchasing bitcoin is immediacy. They say:

Crypto DoldrumsThe good was cheered on Twitter, though it did little to lift the bitcoin price out of the doldrums. Bitcoin at the time of publishing was down about 15% to below the $7,000 threshold, dropping lower than even some of the worst-case scenarios. Venture-backed Bread came on the scene in 2015, with its own digital coin Bread (BRD) lower with the best of them, trading off more than 17%. Featured image from Shutterstock. Follow us on Telegram. Advertisement The post Bread Wallet Enables International Bitcoin Purchases with Credit Cards appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/bread-wallet-enables-international-bitcoin-purchases-with-credit-cards/ AdvertisementGet Trading Recommendations and Read Analysis on Hacked.com for just $39 per month. The chairmen of two top US market regulatory agencies largely stuck to the script during Tuesday’s Senate hearing on potential cryptocurrency regulations. The hearing, which was held by the Senate Committee on Banking, Housing, and Urban Affairs, touched on a broad range of regulatory concerns related to cryptocurrencies and blockchain technology, including initial coin offerings (ICOs), trading platforms, derivatives and exchange-traded funds (ETFs), and the assets’ perceived use to perpetrate financial crimes and subvert international sanctions. In their opening statements, both Clayton and Giancarlo expressed concern about the fact that cryptocurrency exchanges are currently regulated at the state level rather than the federal, and each reiterated that, at some undefined point in the future, Congress may want to increase federal regulators’ ability to oversee the spot markets. Jay Clayton, chairman of the Securities and Exchange Commission (SEC), continually shifted the conversation back to ICOs, noting that he has not seen an ICO that should not be classified as a security under federal regulations — a statement he has repeated on several past occasions. He also provided insight into why the SEC has resisted fund sponsors’ attempts to list Bitcoin ETFs, explaining that because ETFs primarily target retail investors and are largely one-sided markets, rules governing their creation must be more strict than those for futures contracts, which are overseen by the CFTC. He said that, if these rules are satisfied at a later date, the SEC will then be open to reviewing its stance on Bitcoin ETFs. Chairman Giancarlo, meanwhile, won the hearts of Bitcoin enthusiasts with several comments that appeared to be hat tips to the community. First, he made what is almost certainly the first use of the word “hodl” during a Congressional hearing. Then, toward the end of the hearing, he contradicted the common misconception that Bitcoin is riding the coattails of blockchain technology. He told the committee: [embedded content] Altogether, the hearing may not have led to any bombshells, but it confirmed what has already been made apparent: new cryptocurrency regulations are likely coming to the US market. “We may be back with our friends from the U.S. Treasury and the Fed to ask for additional legislation,” Chairman Clayton said during the hearing, and — based on the tone of questions from individual committee members — legislators are likely to give it to them. Featured image from YouTube/CFTC. Follow us on Telegram. Advertisement The post Without Bitcoin, There Would Be No Blockchain: CFTC Chairman Tells US Senate appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/without-bitcoin-there-would-be-no-blockchain-cftc-chairman-tells-us-senate/ AdvertisementGet Trading Recommendations and Read Analysis on Hacked.com for just $39 per month. The timing of the rollout couldn’t be better. Zug, Switzerland-based bitcoin wallet startup Bread unveiled plans to accept international bitcoin purchases via credit card. Bread is boasting features such as “high limits” and same-day delivery for bitcoin purchases, both of which are often missing from cryptocurrency exchanges. By allowing this service, which is a product of a relationship with Simplex, investors can bypass cryptocurrency exchanges, which incidentally top US banks have taken aim at of late. Bread tweeted – While Bread is making it easier for investors to get their hand on bitcoin, banks are making it more difficult. JPMorgan Chase, Bank of America, Citigroup and Lloyd’s in recent days placed a ban on bitcoin purchases via credit card. Cryptocurrency exchanges appear to be tops on banks’ radar for credit card bitcoin purchases. Bread’s decision, meanwhile, came in response to customer demand amid the following idiosyncracies with exchanges –

The Bread app, meanwhile, gives investors what they’re missing from the likes of Coinbase –

Perhaps the best feature of the Bread wallet is it puts the private key in the accountholder’s hands, removing the need to trust a third-party service provider, a decentralized approach that is similarly at the core of the blockchain. This is unlike exchanges, where if a buyer doesn’t own their own digital wallet, the bitcoin is automatically kept in the exchange’s wallet, which as the Coincheck showed the world can be a risky bet in the event of a breach. Bread also draws the conclusion that fees are not an area of concern for investors, which crypto traders may take issue with, especially considering the highly anticipated launch of Robinhood. Bread’s theory is that considering the volatility in the bitcoin price, a buyer’s No. 1 concern when purchasing bitcoin is immediacy. They say:

Crypto DoldrumsThe good was cheered on Twitter, though it did little to lift the bitcoin price out of the doldrums. Bitcoin at the time of publishing was down about 15% to below the $7,000 threshold, dropping lower than even some of the worst-case scenarios. Venture-backed Bread came on the scene in 2015, with its own digital coin Bread (BRD) lower with the best of them, trading off more than 17%. Featured image from Shutterstock. Follow us on Telegram. Advertisement The post Bread Wallet Enables International Bitcoin Purchases with Credit Cards appeared first on Crypto Currency Online. from https://cryptocurrencyonline.co/bread-wallet-enables-international-bitcoin-purchases-with-credit-cards/ |

ABOUT USCrypto currency online is your best source for up to date crypto currency news and technical information. We have brought this website you informed and up-to-date with all the current changes and trends happening in one of the newest industries available and will continue to you our best to date and informed. Crypto currency mining is becoming more and more popular every day. What we've done combined news, information, my crypto currency charts and the best mining products that you can purchase. |

Tsarkov was declared bankrupt in October of last year. The court found that his assets and salary were not enough to pay off the debt of 19 million rubles (~USD$333,000) to Rikas Investment Group.

Tsarkov was declared bankrupt in October of last year. The court found that his assets and salary were not enough to pay off the debt of 19 million rubles (~USD$333,000) to Rikas Investment Group. Tsarkov’s representative argued that cryptocurrencies “are not recognized by the state and thus, they could not be considered as property,” comparing it to quasi-currency used in some computer games, Ria Novosti described. Tsarkov also asserted that crypto transactions are between two parties and “Cryptocurrency has value only for those two people who are [ex]changing them.”

Tsarkov’s representative argued that cryptocurrencies “are not recognized by the state and thus, they could not be considered as property,” comparing it to quasi-currency used in some computer games, Ria Novosti described. Tsarkov also asserted that crypto transactions are between two parties and “Cryptocurrency has value only for those two people who are [ex]changing them.” On Monday, February 5th the Dow Jones Industrial Average dropped more than 1175 points losing $300 billion USD in value in just one intra-day.

On Monday, February 5th the Dow Jones Industrial Average dropped more than 1175 points losing $300 billion USD in value in just one intra-day. One publication, Business Insider says on ‘Black Monday’ money from the stock market sell-off was “pouring into crypto.”

One publication, Business Insider says on ‘Black Monday’ money from the stock market sell-off was “pouring into crypto.” On February 5, 2018, reports detail that traditional banks suffered from the fastest decline on record.

On February 5, 2018, reports detail that traditional banks suffered from the fastest decline on record.

Paul Cherry

Paul Cherry

RSS Feed

RSS Feed